Ratekhoj

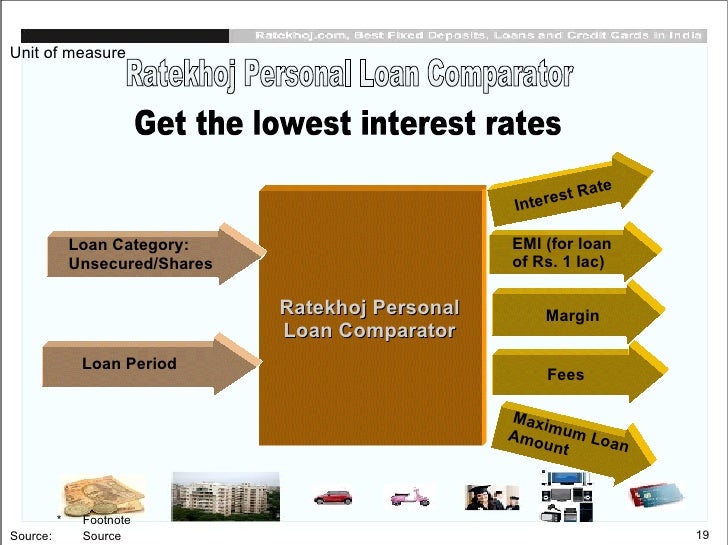

Ratekhoj.com - Fixed Deposit Rates, Lowest Home Loan Rates, Best Credit Cards, Lowest Car Loan Rates, Two Wheeler Loan Rates and Personal Loan Rates, India. Ratekhoj.com is a personal finance website. Jobsrecruitments.com - Jobs and Recruitment Exams India. Saurashtra Gramin Bank one of the leading Regional Rural Banks (RRBs) also known as Gramin banks Providing banking facilities such as Saving Deposit, Recurring Deposit, Fixed Deposit as well as Tractor Loan, Agriculture Term Loan, rural Housing Loan, Education Loan and Personal Loan. Indian Financial System Code (IFSC). It is used for electronic payment applications like Real Time Gross Settlement (RTGS), National Electronic Funds Transfer (NEFT), Immediate Payment Service, an interbank electronic instant mobile money transfer service (IMPS), and Centralised Funds Management System (CFMS) developed by Reserve Bank of India (RBI). Fixed Deposit Calculator: This Fixed Deposit Calculator (FD Calculator) tells you the Maturity Value of your invesment (Principal) when compounding of interest is done on a Monthly, Quarterly. Established Brand. Bharat e Khoj is nationwide recognized and four times national tourism award winner by the Dept. Of Tourism Govt. We at Indian Legends believe in going one step ahead of just “tour organizing” because we believe that customer satisfaction.

watblog.com Startup Updates : Monkiri.com and Ratekhoj.com WATBlog.com - Web, Advertising and Technology Blog in India

Monkiri.com Submitted by Madhu Joshi Monikiri is a tool that enables you to mark out specific areas of the webpage that you are seeing and Read article

Relevancevettyofficer.blogspot.com Vetty Officer's Weblog: Ratekhoj.com

VETTY OFFICER'S WEBLOG. Monday, March 17, 2008. Previous Posts. I Read.... Ratekhoj.com. 0 Comments:. Links to this post:. Labels: Fixed Deposit Rates , Home Loans , Investment , Vehicle Loans. posted by Vetty Officer at 8:24 AM. Post a Comment. Create a Link. Read article

Relevancegyanin.com City Union Bank offers highest fixed deposit rate in Indian Banks ...

Error: You may have typed the template name wrong or ' does not exist. Click here to fix it.. Read article

Relevancefeeds.advocable.com Top personal finance sites in India @dvocable

Chronicling digital marketing trends & experiences, online tools & tips @dvocable. Top personal finance sites in India. 2 Responses to 'Top personal finance sites in India'. Leave a Reply. Chronicling digital marketing trends & experiences, online tools & tips. 2 comments. Of late, I have been do... Read article

Relevancenitawriter.wordpress.com Vote for me « A wide angle view of India

Vote for me. Issues Views Reviews. Blog Stats. Most Recent Posts. Recent comments and replies. Search by subject. DISCLAIMER. Go to a surprise post. My topics. Search all posts by date. Readers on this site now. Pages on Blogging. Meta. Share this:. Like this:. Leave a Reply Cancel reply. Follow ... Read article

Relevance20twentytwo.blogspot.com Twenty22-India on the move: Somewhere in Delhi....

Disclaimer:Most of the information has been obtained by reading various newspapers / magazines , watching television and browsing through various websites.Pictures and Articles used are for informative and illustrative purposes only and their copyright belongs to their respective owners.Some of t... Read article

Relevancejagoinvestor.com Why to open a Public providend funds in India Early

Every one should open a PPF account early in Life , There are many advantages of opening a PPF account in early years which we will discuss in this article . Read article

Relevance

Calculate maturity amount and interest earned on your PPF Account.

PPF balance (with interest) over the year

Closing Balance is displayed left (skyblue color) and the Interest Earned on right (green color) for each year.

Total Amount Deposited as compared to Total Interests Earned

Ratekhoj Bsr Code

Final Maturity Amount is .

Www.ratekhoj.com

PPF Calculator is a simple online tool for PPF related calculations. If you're saving/investing money under PPF scheme, then you may find this little tool useful for doing some calculations e.g interests earned over the period or how your investment grows over the years, final maturity amount etc. Just enter the yearly deposit amount and it calculates (also show you the table and chart) your interest/balance for the next 15 financial years.

What is PPF ?

PPF (Public Provident Fund) is a saving-cum-tax saving scheme in India (started in 1968 by National Saving Institute of the Ministry of Finance) by Central Government. The goal is to mobilize small savings by offering an investment with reasonable returns combined with income tax benefits. (Tax exemption : EEE)

The interest rate is 7.10% per annum (compounded annually) and it's tax free (contribution under 80C and interest earned is fully exempted without any limit). Anyone individual Indian resident(including minor but not NRIs) can open an account with any nationalized bank (SBI, PNB, Central Bank of India etc) or post office or some authorized private banks (ICICI, HDFC, Axis Bank etc). The duration is 15 years and one can deposit anywhere between Rs. 500 (minimum) to 1.5 lac (maximum) per year.

Ratekhoj

Facts About PPF

- Current interest rate : 7.10%

- Duration of scheme : 15 years

- Minimum deposit amount (per year) : 500

- Maximum deposit amount (per year) : 1,50,000

- Number of installments every year : 1 (Min) to 12 (Max)

- Number of accounts one can open : Only One

- Lock-in period : 15 years (partial withdrawals can be made from the sixth year)

- Extension of PPF Account : After the maturity period (15 years), it can be extended for a period of 5 years

- Tax savings (contribution) : under section 80C (upto 1.5 L)

- Tax savings (interest earned and final amount) : fully exempted from wealth tax

Alternatives to Public Provident Fund

Ratekhoj Ifsc

Although, PPF is a good choice in general but it may not be good for everyone. ELSS(Tax Saving Mutual Fund) is also exempted (EEE) like PPF. It can generate better returns (~15% or higher) but it's risky as compare to PPF. Read more detailed comparison here : PPF vs ELSS